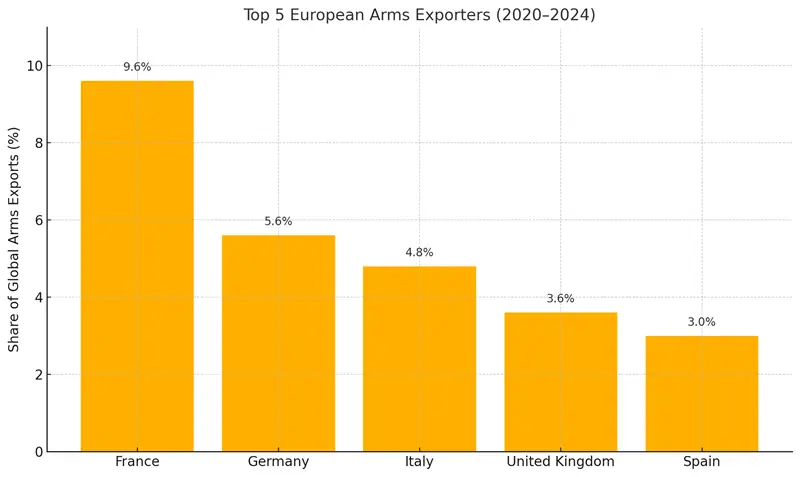

As geopolitical tensions intensify across Europe, Asia, and the Middle East, Europe’s defence industry is emerging as a dominant player in the global arms market. According to SIPRI’s 2025 report on international arms transfers (2020–2024), five European countries — France, Germany, Italy, the United Kingdom, and Spain — are now among the world’s top 10 arms exporters. Together, these five nations accounted for over 26% of global arms exports during this period, contributing significantly to Europe’s strategic and economic clout.

Russia is not included in the list of European arms exporters in this article because SIPRI (Stockholm International Peace Research Institute) — the source of the data — classifies Russia separately from Western Europe due to:

-

Geopolitical reasons: Russia is typically analysed independently given its distinct foreign policy, military industry, and role as a global power rival to NATO countries.

-

SIPRI’s own categorisation: In SIPRI reports, “Europe” usually refers to Western and Central Europe, while Russia and Belarus are treated under Eurasia or as a distinct bloc.

1. France – Europe’s Arms Export Leader

France has firmly established itself as number 2 on the list of the largest arms exporters in the world, behind only the United States. Between 2015–19 and 2020–24, French arms exports grew by 11%, accounting for 9.6% of global transfers. Its primary clients were India (28%), Qatar (9.7%), and Greece (8.3%).

This growth reflects France’s strategic arms diplomacy, particularly in Asia and the Middle East. Dassault Rafale fighter jets and Scorpène-class submarines have become symbols of French military influence. Post-2022, Paris also ramped up support for Ukraine, supplying artillery, missiles, and ships.

2. Germany – Balancing Trade and Ethics

Germany maintained its position as the world’s fifth-largest arms exporter, though with a modest 2.6% decline in volume from the previous period. It accounted for 5.6% of global arms exports between 2020–24. Its top recipients were Ukraine (19%), Egypt (19%), and Israel (11%).

Germany’s arms exports continue to be shaped by its export control regulations and domestic political debates over supplying weapons to conflict zones. Nonetheless, the Russian invasion of Ukraine has led to a more assertive export policy, especially towards NATO allies and partners in Eastern Europe.

3. Italy – A Rapidly Rising Force

Italy has emerged as one of Europe’s fastest-growing arms exporters. Between 2015–19 and 2020–24, Italian exports increased by a staggering 138%, giving it 4.8% of the global market. Key buyers included Qatar (28%), Egypt (18%), and Kuwait (18%).

Italy’s defence industry, led by Leonardo and Fincantieri, has focused on high-value systems like naval vessels and helicopters. Strategic contracts with Gulf countries and North Africa have significantly boosted Rome’s arms footprint abroad.

4. United Kingdom – Steady but Focused

The UK retained its 3.6% share of global arms exports, with relatively stable volumes compared to the previous period. Its main customers were Qatar (28%), the USA (16%), and Ukraine (10%).

While not seeing explosive growth, the UK benefits from long-term defence partnerships, particularly with Gulf states and NATO allies. Its contributions to Ukraine’s defence and continued supply of Eurofighter Typhoon jets to the Middle East keep it firmly in the global top tier.

5. Spain – Quietly Expanding

Spain has steadily increased its arms exports, rising to 3.0% of the global share — a 29% increase over the previous period. Major importers of Spanish arms included Saudi Arabia (24%), Australia (18%), and Türkiye (13%).

Spanish defence firms, such as Navantia and Indra, have made inroads with both NATO and non-NATO partners, focusing on naval platforms, surveillance systems, and air defence technologies.

Conclusion: Top 5 European Arms Exporters in 2025

The top 5 European arms exporters in 2025 are

- France

- Germany

- Italy

- UK

- Spain

The prominence of five European countries among the top global arms exporters reflects a continent that is no longer just a buyer of security but an active shaper of global military power dynamics. As defence budgets rise and geopolitical fault lines deepen, European arms industries are poised to become even more influential — both economically and diplomatically.

However, with this power comes responsibility. The ethical, political, and humanitarian implications of arms transfers will increasingly shape Europe’s future as a global defence hub.

FAQs

Why is France the leading European arms exporter?

A: France has focused on high-value defence equipment like Rafale fighter jets and submarines, securing major contracts with countries such as India, Qatar, and Greece. Its arms diplomacy and expanding influence in Asia and the Middle East have propelled it to second place globally.

What explains Italy’s rapid growth in arms exports?

A: Italy’s arms exports rose by 138% from the previous five-year period, driven largely by deals with Qatar, Egypt, and Kuwait. Naval vessels, helicopters, and strong defence industry players like Leonardo and Fincantieri have helped boost its global presence.

How does Germany balance arms exports with its domestic politics?

A: Germany faces internal debates about exporting to conflict zones. However, since the Russian invasion of Ukraine, Berlin has taken a more active role, becoming a major supplier to Kyiv while maintaining strong exports to Egypt and Israel.

Why is the UK’s export growth relatively flat compared to others?

A: The UK’s arms exports remain stable, supported by long-term contracts with Qatar and NATO allies. While not showing rapid growth, the UK benefits from consistent demand for its advanced systems like the Eurofighter Typhoon.