Steel is the backbone of modern industry, underpinning construction, manufacturing, transportation, and infrastructure development worldwide. As an alloy of iron and carbon, steel’s strength, versatility, and recyclability make it indispensable in everything from skyscrapers and bridges to automobiles and household appliances. In 2025, global steel production remains a key indicator of economic and industrial strength, with certain nations dominating the market due to their vast resources, technological advancements, and robust demand. This article explores the top 10 steel-producing countries in 2025, highlighting their contributions to the global steel industry, based on the latest available data and trends

Global Trends and Challenges

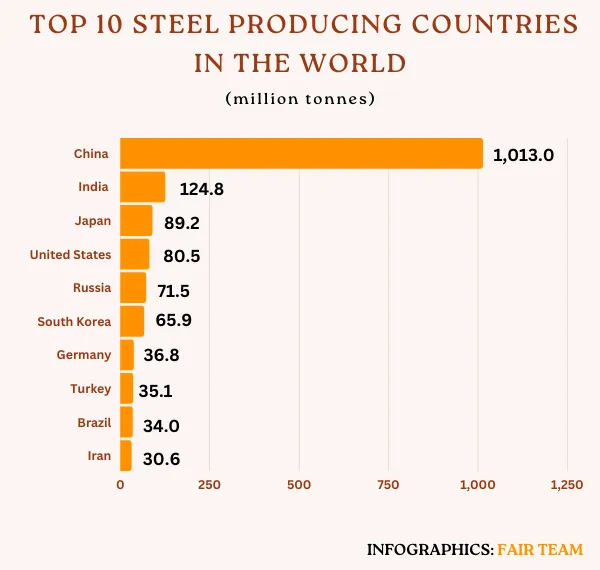

In 2024, global steel production reached 1,882.6 Mt, a slight decrease of 0.8% from 2023. The top 10 countries—China, India, Japan, the United States, Russia, South Korea, Germany, Turkey, Brazil, and Iran—account for over 70% of this output. The industry faces significant challenges, including rising energy costs, environmental regulations, and the need to reduce carbon emissions. Steel production is one of the most energy-intensive industries, contributing 7-9% of global CO2 emissions.

Countries like China and Japan are investing in greener technologies, such as electric arc furnaces and hydrogen-based steelmaking, to align with carbon neutrality goals. Meanwhile, emerging producers like India and Iran are expanding capacity to meet growing domestic and international demand. Geopolitical factors, such as EU trade quotas and sanctions on Russia, continue to shape the global steel market, influencing prices and export dynamics.

List of the top 10 steel producing countries in the world

The top 10 steel producing countries in the world are China, India, Japan, the US, Russia, South Korea, Germany, Turkey, Brazil and Iran.

The chart below represents data from 2022.

China. the top steel producing country in the world

China continues to dominate global steel production, accounting for over half of the world’s output. In 2023, China produced 1,019.1 million tonnes (Mt) of crude steel, representing approximately 54% of global production. While 2024 saw a slight decline to 1 billion tonnes, China’s steel industry remains unparalleled, driven by its massive manufacturing base, extensive infrastructure projects, and strong domestic demand. Major state-owned companies like China Baowu Group, which produced 130.8 million metric tons in 2023, lead the charge, supported by advanced production facilities and significant investments in technology.

China’s rise to dominance began in the 1990s, when it overtook Japan, the United States, and the former USSR to become the world’s top producer. By 2020, it became the first country to produce over 1 billion tonnes annually, even amidst the COVID-19 pandemic. However, China’s steel industry faces challenges, including environmental concerns due to high carbon emissions—steel production accounts for about 7% of global CO2 emissions. Efforts to achieve carbon neutrality by 2060 have led to production cuts, with 2021 and 2022 marking the first consecutive years of decline in decades. Despite this, China’s vast iron ore resources and efficient production processes ensure its continued leadership.

India, the rising star

India has solidified its position as the world’s second-largest steel producer, with an output of 140.8 Mt in 2023, a 12.3% increase from the previous year. This growth trajectory is expected to continue into 2025, driven by robust infrastructure development, urbanization, and a thriving automotive sector. India’s steel production has surged by 75% since 2008, reflecting government initiatives to boost manufacturing and infrastructure. Companies like Tata Steel, which produced 30.18 Mt in 2022, play a pivotal role, with its Kalinganagar plant recognized for adopting Industry 4.0 technologies.

India’s steel industry benefits from abundant iron ore reserves and a focus on expanding production capacity. Unlike China, India’s steel sector is less export-driven, focusing primarily on meeting domestic demand. The government’s National Steel Policy, updated annually, supports this growth by addressing supply chain dynamics and market requirements. However, India faces challenges related to energy costs and environmental regulations, which could impact future production if not addressed

Japan, a high-quality producer

Japan remains the third-largest steel producer, with an estimated 87 Mt in 2023, down 2.5% from the previous year. Despite this decline, Japan’s steel industry is renowned for its high-quality output, particularly in specialty steels used in automotive, machinery, and electronics sectors. Nippon Steel Corporation, producing 43.66 Mt in 2023, is a global leader, with operations in over 15 countries.

Japan’s steel production relies heavily on blast furnaces, which account for 76% of its output. The country’s long history of steelmaking, dating back to the 16th century, has fostered technological expertise, but Japan is also working toward carbon neutrality, which may lead to a deliberate downsizing of its steel industry to reduce emissions. Despite these efforts, Japan’s advanced production techniques and focus on innovation ensure its continued prominence in the global market.

United States, a resilient player

The United States ranks fourth, producing 81.4 Mt of crude steel in 2023, a modest 1.1% increase from 2022. The U.S. steel industry has a storied history, with its first steel mill established in Pennsylvania in 1817. While it was the global leader in the early 20th century, it now faces competition from cheaper imports, particularly from developing economies. Companies like U.S. Steel, which produced 14.49 Mt in 2022, remain key players, with recent mergers, such as Nippon Steel’s $14.9 billion acquisition of U.S. Steel, boosting capacity.

The U.S. steel sector supports construction, automotive, and energy industries, with investments in infrastructure projects driving demand. However, high material costs and rising interest rates pose challenges. The U.S. also exports high-grade steel to nearly 150 countries, with Canada and Mexico as primary buyers. Efforts to modernize production and adopt greener technologies are critical for maintaining competitiveness.

Russia, a resource-rich producer

Russia holds the fifth spot, producing 76 Mt in 2023, a 6% increase from 2022. Russia’s steel industry benefits from vast reserves of iron ore and coal, supporting companies like Novolipetsk Steel, Evraz, and Severstal. The industry serves both domestic and international markets, particularly in construction, transportation, and machinery. Despite sanctions due to the Russia-Ukraine conflict, high oil prices and government support have sustained production.

Russia’s steel output has remained resilient, though it faced a significant drop in June 2022 due to geopolitical tensions. The country’s focus on resource extraction and export markets, particularly in Asia and Europe, ensures its continued relevance, but long-term growth may be hampered by international restrictions.

South Korea, efficiency and innovation

South Korea ranks sixth, with an estimated 70.4 Mt of steel production in 2023. POSCO, operating the world’s largest steel mill in Pohang, is a global leader, with an annual capacity exceeding 30 Mt. South Korea’s steel industry excels in producing high-quality steel for automotive, shipbuilding, and home appliance sectors, leveraging advanced technologies and efficient production processes.

The country’s focus on innovation and sustainability has bolstered its global standing. However, like Japan, South Korea faces challenges related to carbon emissions and is investing in greener manufacturing techniques to align with global environmental goals.

Germany, a high-grade steel hub

Germany, producing 40.1 Mt in 2023, ranks seventh, with a slight 0.8% decrease from 2022. Known for its high-grade steel, Germany’s industry, led by companies like ThyssenKrupp and ArcelorMittal, serves automotive and weaponry sectors. Germany is the fifth-largest steel exporter, with key markets in France, Poland, and the Netherlands.

Germany’s technological advancements position it to potentially overtake other producers in the future, but its focus on specialty steels limits its overall output compared to mass producers like China and India. Environmental regulations and energy costs remain significant hurdles.

Türkiye (Turkey),

Turkey, with 33.7 Mt in 2023, holds the eighth position, despite a 4% decline from 2022. Turkey’s steel industry has shown resilience, recovering from regional political challenges with a 9.7% growth in 2017. The country exports to markets like Egypt and Italy, with a focus on construction-grade steel. However, EU trade quotas may limit export growth in 2025, potentially impacting production.

Brazil, 9th largest steel producer

Brazil produced 31.7 Mt in 2023, down 7% from the previous year, securing the ninth spot. With the world’s second-largest iron ore reserves, Brazil’s steel industry, led by companies like Gerdau and Usiminas, focuses on domestic demand in infrastructure and automotive sectors. The industry is also prioritizing sustainability, adopting scrap-based electric arc furnaces to reduce emissions. Brazil exports primarily to Europe and the U.S., but its production has faced challenges due to global market fluctuations.

Iran, the 10th top steel producer

Iran rounds out the top 10, producing 31 Mt in 2023, a 1.3% increase from 2022. As the largest steel producer in the Middle East, Iran benefits from substantial iron ore reserves and has expanded production through policy reforms and a focus on its metal sector. Companies like Mobarakeh Steel Company drive growth, with exports to Asia, Europe, and the Middle East. The Russia-Ukraine conflict has increased global demand for Iranian steel, boosting its market share.

Summary of the top 10 steel producing countries in the world

In conclusion, Steel production is a critical indicator of a country’s industrial strength and economic development. The top steel-producing countries in the world, including China, India, Japan, the United States, Russia, South Korea, Germany, Turkey, Brazil, and Iran, have a significant impact on global steel supply.

China’s dominance is unmatched, but India’s rapid growth and Iran’s emergence highlight shifting trends. Japan, the U.S., and Germany maintain their positions through innovation and high-quality output, while resource-rich nations like Russia and Brazil leverage their natural advantages. As the industry navigates environmental and economic challenges, these countries will continue to shape the future of steel production, driving global infrastructure and economic development.