Pakistan is currently facing a severe dollar crisis, which is crippling the Pakistan economy. The dollar crisis has led to banks refusing to issue new letters of credit for importers creating a serious shortage of necessary commodities.

How much forex does Pakistan have?

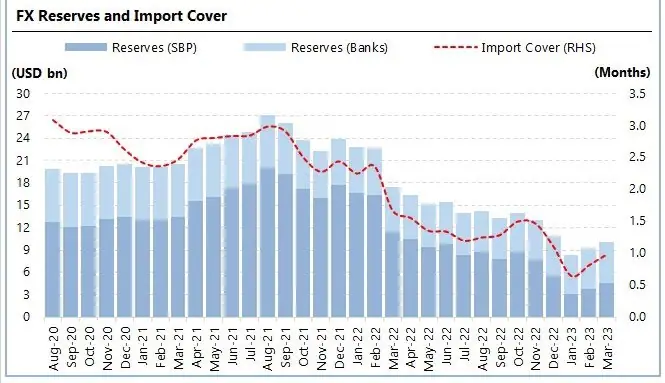

As of March 17, 2023, Pakistan’s Liquid Foreign Exchange Reserves scenario:

Total: $10.1 billion, up by $292 million (March 10, 2023)

Reserves with State Bank of Pakistan: $4.6 billion, up by $ 280 million ( March 10, 2023)

Reserves with Banks: $ 5.5 billion, up by $ 13 million ( March 10, 20230

Import cover : less than one month ( 0.99 month)

Source: Arif Habib Limited

Root causes of Pakistan’s dollar crisis

The root cause of Pakistan’s dollar crisis is a balance of payments deficit that has been exacerbated by a number of factors.

Firstly, Pakistan has been running a large trade deficit for many years (since 2003), which means that it imports more goods than it exports. This has been driven by a combination of high oil prices and a lack of diversification in its economy.

Pakistan needs to buy a lot of oil from other countries and when prices for oil went up globally following the Russia-Ukraine War, the government had to use more of its own money to pay for it.

Pakistan’s exports of goods have declined from $17.742bn (July-Jan FY 2022) to $16.429bn (July-Jan, FY 2023).

In January 2023, Pakistan’s trade deficit expanded by 3.1% YoY to PKR 0.62 billion, up from PKR 0.60 billion in the same month of the previous year. Imports increased by 7.3% to PKR 1.14 billion, while exports rose by 12.9% to PKR 0.52 billion.

Secondly, the Pakistani rupee lost value very quickly, making it one of the worst-performing currencies in Asia. The rupee hit a historic low of Rs276.58 against the US dollar on February 3, 2023, but gradually recovered to Rs259.99 by February 24, 2023, marking a 6% gain, thanks to ongoing crippling import restrictions.

However, the rupee’s resurgence may be short-lived as it is expected to face renewed challenges in the April-June quarter due to persistently weak external sector fundamentals that are unlikely to provide sustained support to the local currency.

When the rupee is worth less, it means that Pakistan has to spend more of its own money to buy the same things from other countries. This exacerbates Pakistan’s dollar shortage crisis.

The instability of the exchange rate is believed by exporters to be one of the main causes of the decline in exports.

Third, debt servicing is a major burden on the forex reserve. Pakistan will require new and larger bailout support from the IMF to continue to continue to service its old external debts.

The decline in remittances from $17.988bn (July-Jan FY 2022) to $16bn (July-Jan, FY 2023) has also had a negative impact on the country’s forex reserves.

Fifth, a consistent and substantial outflow of dollars to Afghanistan has exacerbated Pakistan’s dollar shortage. This outflow can be attributed to the freezing of Afghanistan’s reserves by the United States following the Taliban’s takeover in the summer of 2021. For years, Pakistan had been a recipient of a significant inflow of dollars from Afghanistan, which was primarily derived from economic aid provided by the United States.

Impact of the dollar shortage

Pakistan’s dollar shortage problem has led to banks refusing to issue new letters of credit for importers, which is impacting an economy that is already struggling with high inflation and weak growth. The economic and political instability in Pakistan is having a major impact on the population, with many struggling to afford basic necessities. This has led to long queues for subsidized flour and many people are unable to buy milk, sugar, pulses, or any other necessity.

Furthermore, textile manufacturers are being hit hard by the crisis, with many shutting down and thousands of jobs being lost. Textile manufacturers are responsible for around 60% of Pakistan’s exports. They have been impacted by energy shortages, damage to cotton crops during floods, and a recent hike in taxes. The troubles together have led to around 30 percent of power looms in the city of Faisalabad, the center of the textiles industry, temporarily shutting down, with the loss of thousands of jobs.

In February 2023, the government enacted a supplementary bill to increase the goods and services tax from 17% to 18%, with the aim of generating additional revenue of Rs170 billion ($639 million) for the fiscal year until July.

The Sensitive Price Index showed a record high of 46.65% year-on-year (YoY) for the week ending March 22, primarily due to a significant surge in food prices.

The future of Pakistan’s forex crisis

The fate of Pakistan’s forex reserves hinges on two key factors.

Firstly, how quickly the country receives the pledged forex support from friendly nations following the disbursement of the final tranche worth $1.1bn from the stalled $6.5bn IMF loan in March 2023. However, the IMF has been demanding the withdrawal of remaining subsidies on petroleum products and electricity, which would make it difficult for the government to tackle the situation. Furthermore, with an election due at the end of the year, implementing or campaigning on the tough conditions demanded by the IMF would be political suicide.

During the third week of March 2023, Pakistan’s Finance Minister Ishaq Dar declared that the country had received a second installment of $500 million from the Industrial and Commercial Bank of China Ltd (ICBC). The bank had previously granted a rollover of a $1.3 billion loan to Pakistan.

And secondly, how exports and remittances perform during the April-June quarter of the same year.

Pakistan’s central bank’s ability to cap exchange rates again is now limited, as it lifted the cap on January 26 after having kept the rates range-bound for several months. Pakistan has committed to the IMF that it will not reintroduce exchange rate caps and must fulfill this promise to be eligible for a new, larger bailout program in the upcoming fiscal year starting in July 2023.

FAQs

Will PKR get stronger in 2023?

Despite the IMF resuming its loan program for Pakistan in March 2023, several Pakistani research firms anticipate the Pakistani Rupee (PKR) to remain bleak throughout the year 2023. Some forecast the currency to drop to Rs250-270 against the US dollar by June 30, 2023, while others predict a drop to Rs265-270 by December 31, 2023.

How much is the current deficit of Pakistan? or Is Pakistan’s export increasing or decreasing?

Pakistan experienced a 3.1% YoY increase in its trade deficit in January 2023, which rose to PKR 0.62 billion compared to PKR 0.60 billion in the same month of the previous year. Meanwhile, imports grew by 7.3% to PKR 1.14 billion, and exports increased by 12.9% to PKR 0.52 billion.

Why is Pakistan’s trade deficit increasing?

Since 2003, Pakistan has been recording a persistent trade deficit, largely attributable to its high energy imports. In an effort to address the severe shortage of dollars, the country has now significantly reduced its oil imports, which have had a detrimental effect on the export industry, particularly the textile sector, exacerbating the trade deficit even further.