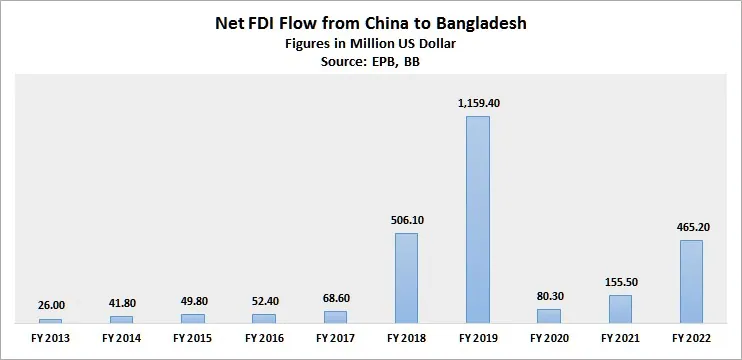

Bangladesh has China as one of its most influential trading partners, and one of the largest sources of Foreign Direct Investment (FDI). China has invested more than $2.6 billion in FDI in Bangladesh over the past 10 years. The two countries have also been engaged in the highest trade volume for the past 12 years, and their trade showed a robust growth of 58% in FY2022. It is worth examining the drivers behind China’s investment in Bangladesh, and whether Chinese investment in the country is a debt trap.

Overview of Chinese Investment

According to Bangladesh Bank (BB) statistics, Chinese investment in Bangladesh grew by 11.5 times in the past seven years from US$52.40 million. The growth of FDI inflow in Bangladesh from China stood at 13.5% year-on-year during the last fiscal year.

Since the visit by Chinese President Xi Jinping to Bangladesh in October 2016, Bangladesh has been observing exponential growth in Chinese investment. The Chinese President pledged to invest US$27 billion in Bangladesh during the visit. Between 2009 and 2019, China invested around US$9.75 billion in infrastructure projects in Bangladesh. The country ranked as the top foreign investor with 104 investors in eight Export-Processing Zones (EPZs).

China’s FDI Projects in Bangladesh

Bangladesh officially joined the Chinese Belt and Road Initiative (BRI) in 2016 during Xi Jinping’s visit. BRI has brought about significant changes in Bangladesh’s infrastructure development sector, with Chinese companies playing a pivotal role in various areas. The partnership between China and Bangladesh has resulted in numerous projects that have bolstered the country’s energy and power sector, transportation network, municipal services, and industrial investments.

Communication Infrastructure

- Padma Bridge

- Paksey Bridge

- The 8th Bangladesh-China Friendship Bridge

- Info-Sarker Phase III

- Huawei Technologies Bangladesh Limited

- Container Terminal at New Mooring, Chittagong

- Mirsarai Coastal Protection Project

- Improvement of Jatrabari Intersection

- The Dhaka Bypass Expressway Project

- Dhaka Elevated Expressway

- Padma Multipurpose Bridge River Training Works Project

- Bangladesh Payra Port First Terminal Project

- BRAC University New Campus Project

- Expansion of Osmani International Airport, Sylhet (1st Phase)

- Bangabandhu Sheikh Mujibur Rahman Tunnel project

- New Dual Gauge Single Railway Line from Dohazari to Cox’s Bazar via Ramu LOT-2

- GoB-funded Extension of Runway at Cox’s Bazar Airport.

- China-Bangladesh Friendship Bridge

- Construction of the Tongi to Bhairab Double Track Line

Energy & Power

- Patuakhali 1320 (2 x 660) MW Coal-Fired Thermal Power Plant Project

- The Saidpur Project

- Expansion and Strengthening of Power System Network under DPDC Area

- Bangladesh Payra 2x660MW Ultra-Supercritical Coal-Fired Power Plant Phase I Project

- SS Power I 2×660 MW Supercritical Coal-Fired Power Plant Project

- Various types of construction work at Barapukuria Coal Mine

- Barisal 1×350 MW Coal-Fired Power Plant Project

- Single-Point Mooring with Double-Line Pipeline project

- Re-Powering Project of Ghorasal 3rd / 4th Unit

- Khulna 330MW Combined Cycle (Duel Fuel) Power Plant Project

- Liz / Lida Rooftop Solar System

Factories & Equipment

- Transsion Bangladesh Limited

- Bangladesh Smart Electrical Co., Ltd. (BSECO) ( In collaboration with Hexing Electrical Co., Ltd)

- LDC Group

Municipal Facilities

- Dasherkandi Sewage Treatment Plant Project

- Construction of Surface Water Treatment Plant and Impounding Reservoir for Khulna Water Supply Project

- Padma Water Treatment Plant (Phase I)

- Ghorasal Polash Urea Fertilizer Project

- RPGCL Kailashtilla Condensate Project

- New Hope Bangladesh ( A group of six companies)

- Newtop Textile (BD) LTD.

- Sany Heavy Industry Bangladesh Limited

Will China continue investing in Bangladesh?

Bangladesh is likely to see more investment in the coming days due to the country’s resilient growth. As per disclosure by Bangladesh Investment Development Authority (BIDA), at least 15 Chinese companies brought direct investment in Bangladesh in 2022 alone. According to the latest update, a glass company, two garment companies and a biotech firm from China are in the pipeline to invest nearly US$785 million during the recent time. In addition, more investments from China may take place in the apparel sector of Bangladesh in the near future.

What Bangladesh is offering to China?

Bangladesh is offering special benefits to Chinese investors by allocating 783 acres of land in a special economic zone situated in Anwara upazila of Chattogram. The Bangladesh government planned to develop special economic zones to prompt rapid economic development by increasing and diversifying industry, creating more employment, and boosting production and export.

How Chinese investment is benefitting Bangladesh?

Chinese companies have made significant contributions to Bangladesh’s power generation capacity, especially as the country’s energy demand has surged in recent years. They have invested in diverse energy sources such as coal, solar, and wind power plants, ensuring a diversified energy mix for Bangladesh.

In the transportation sector, Chinese companies have also made remarkable contributions. The construction of 12 highways spanning 550 kilometers and 21 bridges, along with seven railway lines totaling 541.9 kilometers, has been a major achievement. These infrastructure developments have become essential components of Bangladesh’s transportation network, facilitating the efficient movement of goods and people across the country.

Chinese companies have constructed sewage treatment plants, enhancing water quality in cities like Dhaka and contributing to reduced pollution levels and improved living conditions for the citizens.

Furthermore, Chinese investments in the manufacturing sector have led to the establishment of numerous manufacturing plants, creating thousands of job opportunities for Bangladeshi citizens. These factories have been instrumental in driving economic growth, promoting local entrepreneurship, and elevating living standards in the country.

Around 1,000 Chinese enterprises currently in operation in Bangladesh have created approximately 550,000 employment opportunities. Notably, within the Export Processing Zones (EPZs), these enterprises have generated employment for 129,000 individuals.

Why is China increasingly investing in Bangladesh?

Bangladesh saw rapid growth in Chinese investment from 2016 when the country decided to become part of China’s Belt and Road Initiative (BRI). The objective of BRI is to strengthen regional cooperation by connecting the sub-regions of South Asia, Southeast Asia, and the Middle East. After Bangladesh being part of BRI, the President of China Xi Jinping visited and dramatically changed the investment paradigm for Bangladesh. From thereon, the economic ties between the two nations got stronger. However, recently, Bangladesh has been experiencing a further boost in Chinese investment due to the US-China trade conflict. Due to the conflict, Chinese manufacturers continued to relocate their production facilities to alternative locations like Bangladesh which might facilitate their trade.

Is Chinese Investment a ‘debt trap’ for Bangladesh?

After Pakistan’s Gwadar Port and Sri Lanka’s Hambantota, the issue of the ‘debt trap’ comes as a concern for Bangladesh as well. Bangladesh seemed to lean toward China’s BRI after being refused by the World Bank for financing the Padma Bridge project. However, whether the Chinese loans may turn into a debt trap for Bangladesh depends on sustainable financing and the economic viability of the projects undertaken.

Bangladesh is the second-largest borrower from China in South Asia after Pakistan. While Pakistan is in a critical state with respect to its debt from China, Bangladesh demonstrated caution in debt management.

Comparing the external debt ratio with other BRI member countries that fell into the “debt trap” suggests that Bangladesh showed prudence in respect of debt management. The debt ratio to nominal GDP in the case of Sri Lanka and Pakistan were 104% and 41% respectively while in the case of Bangladesh, the ratio was 22% of its GDP in the fiscal year 2020-21. Moreover, the average interest rate on these loans is approximately 1.23%. Bangladesh has an average of 30 years to repay the loans and an average grace period of 8 years.

Bangladesh has also exhibited a consideration for the economic sustainability of the projects. The country, for example, called off the Chinese project at Sonadia realizing that it will be redundant as the Chinese-proposed port location is close to the Japan-proposed deep-sea port project at Matarbari.

Summary

Bangladesh is important for both the United States and China as part of their respective Indo-Pacific strategy. The current trend suggests that Bangladesh has been pursuing watchful economic engagement with China through BRI while maintaining a balanced relationship with the United States. If this trend continues, the BRI has the potential to create a win-win situation and concrete bilateral partnership with China instead of becoming a debt trap for Bangladesh.